FintechZoom NVDA Stock: Key Insights and Latest Updates 2025!

FintechZoom NVDA stock offers real-time updates, expert insights, and detailed analysis on NVIDIA’s market performance. Investors use FintechZoom to track NVDA stock prices, growth drivers such as AI and data centres, and analyst ratings to make smarter decisions. This makes FintechZoom NVDA stock a key resource for anyone interested in NVIDIA’s fast-growing tech and AI business.

Stay tuned with us for the latest updates and insights on FintechZoom NVDA stock.

What Is FintechZoom NVDA Stock and Why Should Investors Care?

FintechZoom NVDA stock is a popular search term that combines two key elements: FintechZoom, a financial news platform, and NVDA stock, the trading symbol for NVIDIA Corporation. When investors search for FintechZoom NVDA stock, they are looking for simple, real-time updates and expert insights about NVIDIA’s stock performance.

FintechZoom provides clear reports, charts, and forecasts that help individuals understand where NVDA stock stands today and where it may be headed. This is helpful for both new and experienced investors who want to make wise choices.

NVIDIA is a leading technology company renowned for its GPU and AI chip designs. These products are used in gaming, data centres, and self-driving cars. Due to this, NVDA stock is one of the most closely watched in the market.

Investors care about FintechZoom NVDA stock because it provides a single platform to view real-time prices, analyst ratings, stock news, and more. This saves time and facilitates better decision-making.

How Does FintechZoom Analyse NVIDIA’s (NVDA) Stock Performance?

FintechZoom NVDA stock coverage offers a smart way to understand how NVIDIA’s stock is doing. The platform examines various aspects of stock performance, including price trends, trading volume, and market movement. It utilises easy-to-read charts and tools to illustrate how NVDA stock has risen or fallen over time.

FintechZoom also includes expert opinions and analyst ratings. These help readers know if NVDA stock is a “buy,” “hold,” or “sell.” The site collects data from major banks and investment firms, providing users with trusted insights.

Another helpful part of the FintechZoom NVDA stock page is the technical analysis. This illustrates key levels of support and resistance, enabling traders to plan when to enter or exit the market.

What Makes NVIDIA (NVDA) a Leader in the Tech and AI Industry?

NVIDIA is not just a tech company—it’s a leader in AI and graphics. One reason why the FintechZoom NVDA stock page gets so much attention is that NVIDIA powers the tools behind many modern technologies.

The company makes advanced GPUs, which are used in gaming, AI, data centres, and even self-driving cars. These chips help speed up deep learning and machine learning tasks, making NVIDIA a key player in the AI space.

What sets NVIDIA apart is its focus on innovation. From gaming graphics to AI cloud services, the company leads in every area it touches. This strong position is why investors closely follow FintechZoom NVDA stock updates to track the company’s performance.

With powerful products, steady growth, and high demand, NVIDIA continues to set the pace in both the tech and AI industries.

What Are the Key Growth Drivers for NVDA Stock in 2024?

If you’re tracking FintechZoom NVDA stock, here’s what’s pushing NVIDIA’s stock forward this year:

AI Boom

AI is growing fast, and NVIDIA builds the chips that power it. From ChatGPT to self-driving tech, demand for AI hardware boosts NVDA stock.

Data Centre Expansion

Big names like Amazon, Google, and Microsoft use NVIDIA GPUs in their cloud services. This growing demand fuels long-term growth and catches attention on the FintechZoom NVDA stock page.

Gaming Still Strong

Gamers love NVIDIA GPUs. Even with new revenue streams, gaming continues to drive solid sales and steady performance for NVDA stock.

Automotive Growth

Self-driving cars need powerful chips, and NVIDIA’s DRIVE platform delivers. This new segment adds more value to the company and shows up in FintechZoom’s growth analysis.

Strong Partnerships

Collaborations with tech leaders like Tesla, Meta, and Oracle keep NVIDIA ahead. These deals often lead to price jumps tracked on FintechZoom NVDA stock charts.

Innovative Product Launches

New chip designs and AI platforms are helping NVIDIA stay ahead of the competition. Innovation like this keeps investors interested—and keeps FintechZoom NVDA stock trending.

How Has NVIDIA’s AI and GPU Innovation Fueled Its Stock Growth?

FintechZoom NVDA stock shows how NVIDIA’s focus on AI and GPU innovation drives strong stock growth. NVIDIA creates powerful GPUs that are the heart of AI systems. These chips enable computers to learn, think, and solve problems more efficiently. This technology is in high demand for applications such as gaming, cloud computing, and autonomous driving.

Due to this innovation, NVIDIA attracts many investors who closely monitor FintechZoom NVDA stock updates. The company’s new AI products and better GPUs boost revenue and profits. This success is reflected in rising stock prices, making NVDA stock popular among traders and long-term investors.

Simply put, NVIDIA’s leadership in AI and GPU tech keeps the stock moving up, and FintechZoom NVDA stock helps investors stay informed about this growth.

What Are NVIDIA’s Main Revenue Streams Beyond Gaming?

When examining FintechZoom NVDA stock, it’s essential to recognise that NVIDIA generates revenue from sources beyond gaming. While gaming GPUs are famous, NVIDIA’s most significant growth now comes from other areas.

First, data centres are a huge revenue source. Companies use NVIDIA’s powerful GPUs to run AI models and cloud computing services. This segment has grown rapidly and significantly contributes to NVDA’s stock value.

Second, the automotive sector is another key area. NVIDIA’s DRIVE platform helps build self-driving car systems. This market is growing, and investors watch FintechZoom NVDA stock to see how it performs.

Lastly, professional visualisation serves industries such as design, film, and architecture, utilising NVIDIA’s technology to create realistic graphics.

These revenue streams beyond gaming demonstrate why FintechZoom NVDA stock attracts investors seeking diverse growth opportunities.

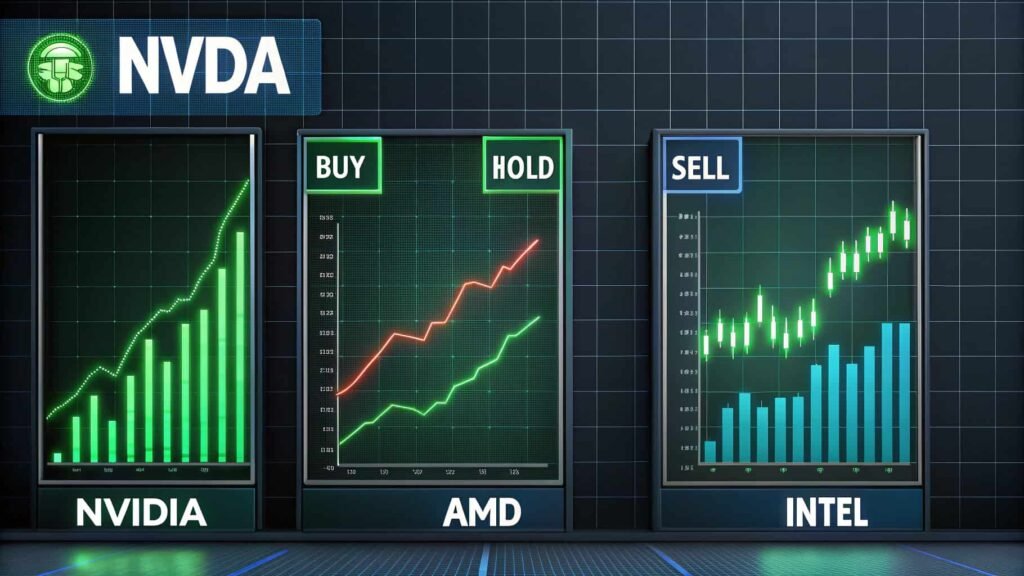

How Does NVDA Stock Compare to Competitors Like AMD and Intel?

When checking FintechZoom NVDA stock, many investors wonder how NVIDIA compares to rivals like AMD and Intel. NVIDIA leads in AI and GPU technology, giving it a significant edge over its competitors. While AMD focuses on CPUs and GPUs, and Intel is strong in processors, NVIDIA’s AI-driven growth sets it apart.

This difference often reflects in NVDA stock performance, with many seeing it as a more aggressive growth play compared to AMD and Intel. FintechZoom helps track these comparisons by showing real-time prices, analyst opinions, and market trends, making it easier to see how NVDA stock performs within the competitive tech space.

What Impact Has the NVIDIA Stock Split Had on NVDA Shares?

The recent NVIDIA stock split has caught the attention of many watching FintechZoom NVDA stock. A stock split means dividing existing shares into more shares, which lowers the price per share but does not change the company’s overall value. For NVDA stock, this move made the shares more accessible to everyday investors, thereby increasing trading activity.

This higher accessibility can boost demand and sometimes lead to short-term price gains. Investors use FintechZoom to monitor how the stock split influences NVDA stock price and volume, helping them decide when to buy or sell shares.

What Are the Latest NVDA Stock Price Predictions on FintechZoom?

As of May 31, 2025, FintechZoom NVDA stock reflects NVIDIA’s current trading price at $135.13 USD, with a slight decline of -0.03% from the previous close. Analysts have set various price targets for NVDA stock:

- Goldman Sachs: $600, rated as “Strong Buy”

- Morgan Stanley: $650, rated as “Overweight”

- Bank of America: $680, rated as “Buy”

These projections are based on NVIDIA’s leadership in AI and GPU markets, indicating strong growth potential.

What Is the Market Sentiment Around NVDA Stock According to FintechZoom?

Investor sentiment for NVDA stock is currently positive. Despite challenges such as the $4.5 billion charge due to U.S. export restrictions on H2O chips to China, NVIDIA’s strong earnings report, with a 69% year-over-year revenue increase to $44.06 billion, has bolstered confidence.

Technical indicators, such as a bullish flag pattern and a golden cross between moving averages, suggest continued upward momentum for NVDA stock.

What Are Analysts’ Ratings and Recommendations for NVDA Stock?

When following FintechZoom NVDA stock, it’s clear that many top analysts are optimistic about NVIDIA’s future. Major firms, including Goldman Sachs, Morgan Stanley, and Bank of America, have assigned NVDA stock strong buy or overweight ratings. These recommendations are based on NVIDIA’s leadership in AI, data centres, and gaming technology.

Analysts often highlight the company’s innovation and growing partnerships as reasons to stay bullish. For investors, tracking these analyst ratings on FintechZoom can help make better-informed decisions about buying or holding NVDA stock.

What Risks and Challenges Should NVDA Stock Investors Be Aware Of?

While FintechZoom NVDA stock shows a strong growth story, investors should be aware of the associated risks. A high valuation means the stock price is already expensive, which may concern value-focused investors. Geopolitical tensions, particularly between the U.S. and China, could disrupt NVIDIA’s supply chain and negatively impact earnings.

Additionally, the tech sector is known for its volatility, and sudden market swings can impact NVDA stock in the short term. Being aware of these challenges helps investors utilise FintechZoom tools wisely to manage the risk associated with NVDA stock.

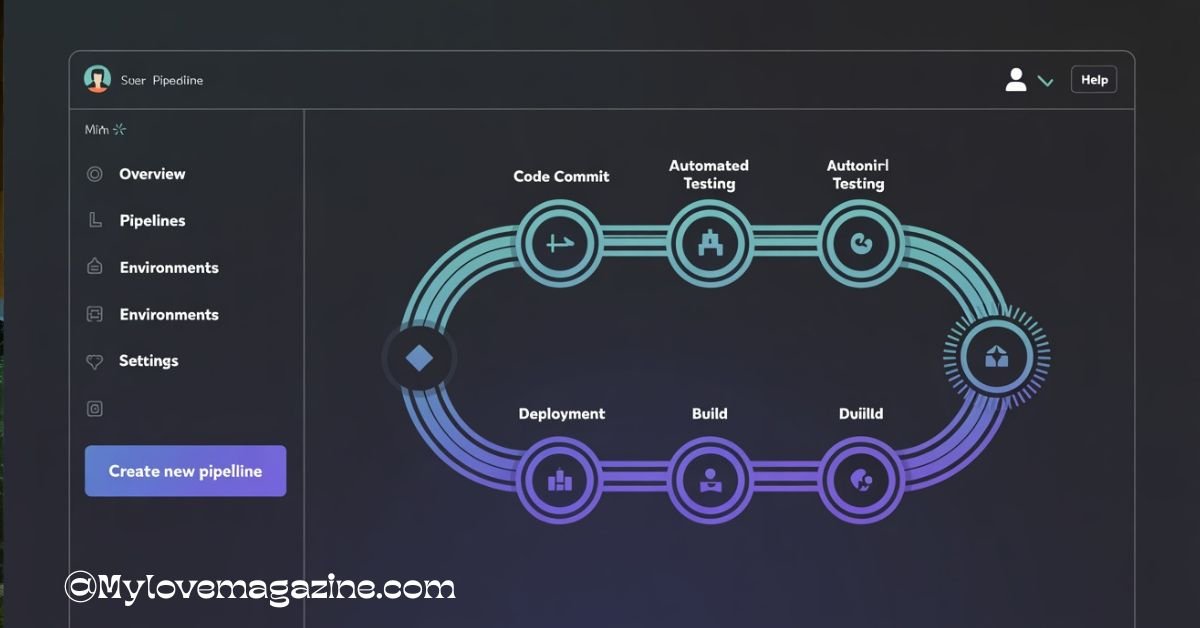

How Can FintechZoom Tools Help You Track and Analyse NVDA Stock?

FintechZoom NVDA stock offers a suite of tools designed to help investors effectively monitor and analyse NVIDIA’s stock performance. The platform provides real-time stock prices, including the latest data on NVDA’s trading activity.

Users can access comprehensive charts and technical analysis indicators, such as moving averages and the Relative Strength Index (RSI), to identify potential entry and exit points.

Additionally, FintechZoom aggregates analyst ratings and price targets for NVDA stock, offering insights into market sentiment and future expectations. These features enable investors to make informed decisions based on up-to-date information and expert analyses.

What Are the Most Recent News and Updates About NVDA on FintechZoom?

FintechZoom NVDA stock regularly features the latest news and updates related to NVIDIA, keeping investors informed about significant developments. Recent articles highlight NVIDIA’s performance, including its response to market fluctuations and strategic initiatives. For instance, discussions around NVIDIA’s stock movements and market trends provide valuable context for understanding the factors influencing NVDA’s valuation. By staying updated with FintechZoom NVDA stock, investors can gain insights into the company’s activities and how they may impact stock performance.

How Does FintechZoom Assess NVIDIA’s Financial Health and Future Prospects?

FintechZoom NVDA stock provides investors with comprehensive insights into NVIDIA’s financial performance and future outlook. The platform highlights NVIDIA’s impressive revenue growth, with a reported $130.5 billion in fiscal 2025, marking a 114% increase from the previous year.

Key financial metrics, including strong profit margins, robust cash flow, and strategic investments in AI and data centre technologies, underscore the company’s solid financial health. Analysts on FintechZoom NVDA stock project continued growth, driven by NVIDIA’s leadership in AI and GPU markets, making it a compelling option for long-term investors.

What Are the ESG (Environmental, Social, and Governance) Insights for NVDA Stock?

FintechZoom NVDA stock also provides valuable insights into NVIDIA’s ESG (Environmental, Social, and Governance) performance. According to Sustainalytics, NVIDIA holds a low ESG risk rating of 12.5, ranking 5th out of 371 companies in its industry. This rating reflects NVIDIA’s practical management of material environmental, social, and governance (ESG) risks, including its commitment to sustainability and ethical governance practices.

Investors utilising FintechZoom NVDA stock can access detailed ESG reports, aiding in making informed decisions that align with responsible investment strategies.

How Can You Buy NVDA Stock and What Should You Know Before Investing?

Buying FintechZoom NVDA stock is simple and accessible through most online brokerage platforms. To get started, open an account with a trusted broker, deposit funds, and search for NVIDIA by its ticker symbol NVDA. Once you place a buy order, you become a shareholder in one of the leading tech companies in AI and GPUs.

Before investing, it’s essential to understand the risks and rewards. NVIDIA is a high-growth company, but its stock price can be volatile due to market shifts and industry competition.

Utilising tools on FintechZoom NVDA stock, such as real-time data, analyst ratings, and news updates, enables you to stay informed and make more informed investment choices. Always consider your investment goals and risk tolerance before adding NVDA stock to your portfolio.

FAQ’s

1. Did Jensen Huang sell NVIDIA stock?

Yes, Jensen Huang, NVIDIA’s CEO, has been selling shares as part of a prearranged plan (Rule 10b5-1) initiated in March 2025. He plans to sell up to 6 million shares, valued at approximately $800 million, by the end of 2025. This strategy is designed to mitigate concerns about insider trading.

2. Is NVIDIA still a good investment?

Analysts maintain a “Strong Buy” consensus on NVDA stock, with an average 12-month price target of $172.43, suggesting a potential upside of about 23% from current levels. Despite short-term challenges, such as export restrictions impacting Chinese sales, NVIDIA’s leadership in AI infrastructure continues to drive investor confidence.

3. Who is the transfer agent for NVDA?

NVIDIA’s transfer agent is Computershare, located at 150 Royall Street, Canton, Massachusetts 02021.

4. What is a good price to buy NVDA?

Analyst opinions vary, with some suggesting that NVDA stock is currently overvalued. For instance, Forbes estimates an intrinsic value of around $100 per share, indicating a potential downside of over 25% from current levels. Conversely, Morningstar’s fair value estimate is approximately $125 per share. It’s essential to consider these perspectives and conduct thorough research before making investment decisions.

5. Is Nvidia stock overvalued?

Valuation opinions differ:

- Forbes estimates an intrinsic value of around $100 per share, suggesting overvaluation.

- Zacks assigns a Value Score of D, indicating it may not be a good pick for value investors.

- Ziggma‘s fundamental analysis indicates that NVDA is not overvalued, with a forward P/E ratio of 30x for 2026, which can be justified for a high-growth company.

These varying assessments underscore the importance of considering multiple perspectives and conducting thorough research.

6. Which is a better investment: AMD or NVDA?

NVIDIA is currently considered a better investment for AI-focused growth:

- NVIDIA holds up to 95% of the AI processor market, while AMD is growing but not keeping pace with it.

- Over the past 10 years, NVIDIA has outperformed AMD with an annualised return of 74.01%, compared to AMD’s 47.32%.

However, AMD may offer value for investors seeking diversification or exposure to different segments of the semiconductor industry.

Conclusion

FintechZoom NVDA stock shows strong potential thanks to NVIDIA’s leading role in AI and GPU technology. With growing revenue streams and solid partnerships, the company continues to attract investor interest.

While there are risks, such as market volatility and high valuations, tools on FintechZoom help you stay informed and make smarter decisions. Whether you’re new to investing or experienced, keeping an eye on NVDA stock through FintechZoom is a smart way to track one of the most exciting tech companies today.

Post Comment