Mygreenbucks Kenneth Jones: Leading Sustainable Finance Today!

Discover how Mygreenbucks Kenneth Jones is transforming sustainable finance with innovation, education, and impact-driven investing.

Let me know if you’d like this article exported to PDF or formatted for WordPress!

Who Is Kenneth Jones and How Is He Leading the Way in Sustainable Finance?

Kenneth Jones is a visionary entrepreneur and thought leader in the field of sustainable finance. With over a decade of experience, he is best known for founding Mygreenbucks, a financial platform focused on eco-investments. Unlike many in the financial sector who are driven by short-term returns, Kenneth is committed to the long-term sustainability of both capital and the environment.

What sets Kenneth apart is his ability to merge financial insight with environmental ethics. He believes finance should serve the planet—not harm it—and that green investments can generate solid, measurable returns. As the face of Mygreenbucks, he speaks at global finance and sustainability events, promoting the idea that investing responsibly is not just a moral choice but a smart economic strategy.

What Is the Vision Behind Mygreenbucks and Why Was It Created?

The creation of Mygreenbucks in 2010 stemmed from Kenneth Jones’ frustration with traditional finance models that ignored environmental consequences. His vision was to create a transparent platform where every investment had a measurable ecological impact.

Mygreenbucks was founded on three primary goals:

- Support green innovation

- Empower everyday investors

- Encourage ethical financial choices.

At a time when few platforms catered to environmentally conscious investors, Mygreenbucks filled a critical gap. It now connects thousands of investors with verified eco-projects, ranging from clean energy to zero-waste startups. Jones’ vision continues to evolve, but its foundation remains the same: use finance as a tool for global good.

How Did Kenneth Jones Build His Career in Sustainable Finance?

Kenneth began his career in conventional finance, working at several investment firms in the early 2000s. However, the 2008 financial crisis changed his outlook. He witnessed firsthand how unchecked financial systems could wreak havoc, not just economically but also environmentally.

This realization pushed him to study sustainable business models and green investment principles. He gradually shifted his career focus, eventually launching Mygreenbucks with a small but passionate team. His journey wasn’t without challenges, but his persistence and ethical approach have earned him a reputation as a trailblazer in green investing.

What Are the Core Values That Guide Mygreenbucks?

At the heart of Mygreenbucks Kenneth Jones lies a commitment to three guiding values:

- Transparency: Investors receive clear information about where their money is going and the impact it makes.

- Integrity: Only projects that meet strict environmental and ethical standards are approved.

- Sustainability: Every financial decision supports a long-term ecological goal.

These values are embedded in the company’s decision-making process. Whether selecting new ventures or building investor relationships, Mygreenbucks maintains strict internal guidelines to ensure alignment with its mission. These principles are what make the platform trusted by its global user base.

What Are the Key Initiatives Launched by Mygreenbucks?

Mygreenbucks has launched several impactful programs to promote sustainable investing:

- Green Project Fund: Pooled investment options for projects focused on renewable energy, waste reduction, and biodiversity.

- Eco Incubator: An initiative supporting startups that address pressing environmental issues.

- Mygreenbucks Academy: An online education platform providing accessible content on responsible finance.

Each initiative not only delivers strong return potential but also fosters a sense of community among investors who care about the planet. Kenneth believes that real change happens when investors are empowered with both knowledge and opportunity.

How Does the Mygreenbucks Crowdfunding Program Work?

One of the standout offerings from Mygreenbucks is its crowdfunding program. Designed for both beginners and experienced investors, this tool allows users to fund specific green projects with small contributions.

Here’s how it works:

| Step | Action |

| 1 | Browse a list of eco-friendly projects |

| 2 | View project details, risks, and impact reports |

| 3 | Choose how much to invest |

| 4 | Track performance and environmental benefits in real time |

This model not only decentralizes green investment but also democratizes it, allowing people from all financial backgrounds to be part of something impactful.

Why Does Mygreenbucks Focus on Financial Education?

Kenneth Jones firmly believes that knowledge is the foundation of sustainable change. That’s why Mygreenbucks invests heavily in financial education. The goal is to help people understand how their money can be a force for good and how sustainable finance actually works.

Through online workshops, expert panels, and written guides, users learn:

- How to assess the environmental impact of a company

- What do ESG (Environmental, Social, Governance) metrics mean

- How to build a sustainable portfolio

Educated investors are more likely to stay committed to green practices, which is why this focus remains central to the company’s mission.

What Challenges Has Kenneth Jones Faced with Mygreenbucks?

Despite his success, Kenneth Jones has faced notable obstacles. Initial skepticism from traditional investors was a significant hurdle. Many were wary of the long-term viability of sustainable investments.

Moreover, regulatory hurdles and greenwashing—companies pretending to be sustainable—posed constant challenges. Kenneth had to develop rigorous vetting processes to ensure that only genuine projects made it onto the platform.

Even with these challenges, Jones has stayed the course, proving that resilience and firm ethical grounding can turn a niche idea into a global movement.

Why Are People Still Skeptical About Sustainable Investments?

Many people remain hesitant about green finance due to myths like:

- “Sustainable investing offers lower returns.”

- “It’s too complicated to evaluate impact.”

- “It’s just a trend.”

Kenneth Jones and Mygreenbucks counter these doubts by providing data-backed results and real-world case studies. For example, green projects funded via Mygreenbucks have consistently met or exceeded ROI expectations. Transparency and education continue to play a significant role in dispelling skepticism.

How Does Mygreenbucks Stay True to Its Values While Growing?

Growth often comes with the risk of compromise, but Mygreenbucks Kenneth Jones has created a framework that balances expansion with core principles. Every new partnership undergoes environmental due diligence. Kenneth himself is involved in strategic decisions, ensuring that no shortcut undermines the mission.

Rather than chasing growth at any cost, the company opts for sustainable scaling—a slower but values-aligned strategy that has built long-term credibility.

What Is the Deeper Mission Behind Mygreenbucks?

At its core, Mygreenbucks aims to change how people view and use money. It’s not just a platform—it’s a philosophy. Kenneth believes that responsible finance has the power to reshape economies, communities, and ecosystems.

By channeling capital into green solutions, Mygreenbucks is helping rewrite the rules of investing, shifting focus from short-term profit to long-term planetary well-being.

What Does Responsible Finance Mean at Mygreenbucks?

Responsible finance at Mygreenbucks means:

- Only investing in projects with verified environmental impact

- Holding companies accountable through ongoing reporting

- Giving investors tools to make informed, ethical choices

It’s about aligning financial outcomes with societal and ecological progress, and ensuring that money becomes a solution, not a problem.

How Does Mygreenbucks Educate and Raise Awareness Among Investors?

Beyond its Academy, Mygreenbucks runs:

- Monthly webinars

- Investor newsletters

- Social media explainers

These channels help simplify complex topics like ESG scoring, carbon offsets, and sustainable market trends. Education turns passive users into active contributors to a green future.

What Are the Main Challenges and Future Goals for Mygreenbucks and Kenneth Jones?

As the market becomes more saturated with green startups, Kenneth Jones’ next challenge is differentiation. He plans to:

- Expand into emerging markets

- Introduce AI-powered green risk assessment tools.

- Partner with universities for climate finance research

The long-term goal? Make sustainable investing the global standard.

What Obstacles Does the Sustainable Finance Sector Currently Face?

Sustainable finance still grapples with:

- Lack of standardized metrics

- Greenwashing threats

- Regulatory fragmentation across regions

Mygreenbucks tackles these by adopting international reporting frameworks and demanding full project accountability.

How Is Kenneth Jones Working to Educate Consumers About Green Finance?

Kenneth personally participates in interviews, writes blog posts, and appears in educational videos. His hands-on approach shows his commitment to transparency and direct community engagement.

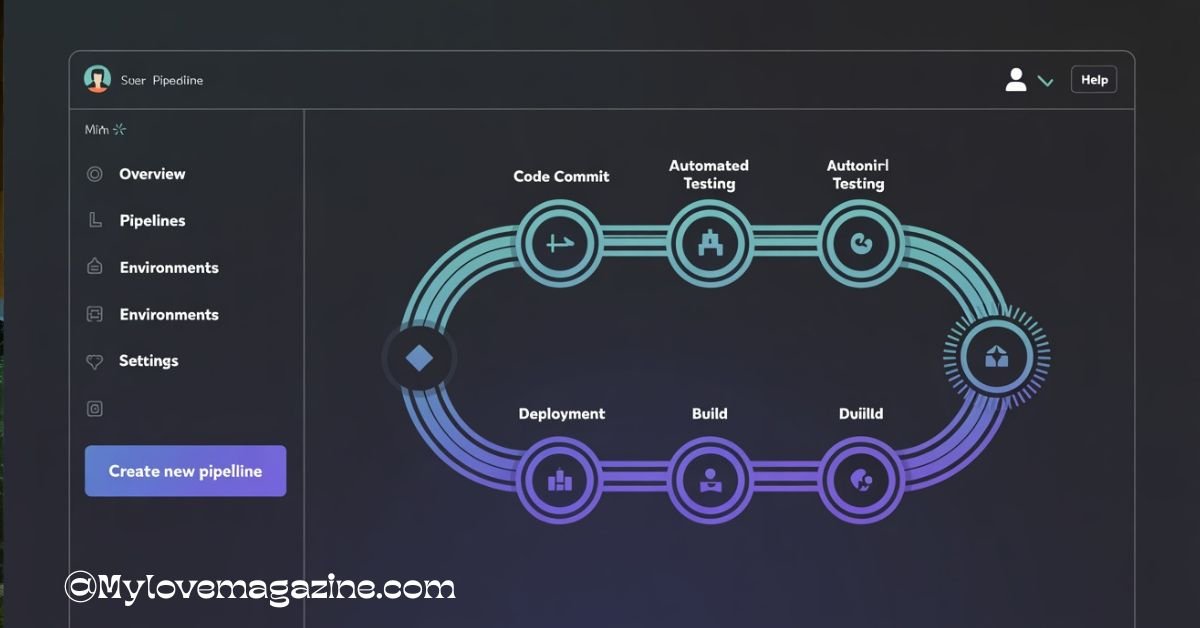

How Does Technology Support the Growth of Sustainable Finance?

Technology plays a massive role at Mygreenbucks:

- Blockchain ensures fund traceability

- AI helps match users with projects based on preferences.

- Mobile apps offer real-time impact tracking.

This digital ecosystem makes sustainable investing easy and intuitive.

Why Is Financial Education Important for Green Investing?

Without understanding the impact of their choices, investors can unknowingly support harmful practices. That’s why Mygreenbucks puts education first—it ensures people know how and why their money matters.

What Innovations Are Helping Make Responsible Finance More Transparent and Accessible?

Innovations include:

- Green bonds are available via Mygreenbucks

- Impact dashboards showing real-time carbon offset metrics

- Smart contracts ensure investment terms are met.

These tools help make green finance not just accessible, but trustworthy.

FAQ.s

1. Is Mygreenbucks suitable for beginners in investing?

Yes, Mygreenbucks is designed to be user-friendly and educational, making it ideal for both beginners and seasoned investors.

2. How do I know a project on Mygreenbucks is truly sustainable?

Each project is vetted through a strict environmental and ethical review, and impact reports are shared openly with investors.

3. Can I invest internationally with Mygreenbucks?

Yes, the platform offers access to global projects, including clean energy, agriculture, and waste management.

4. Are Mygreenbucks returns competitive with traditional investing?

Data shows that many green investments offer competitive, and sometimes superior, long-term returns.

5. What makes Kenneth Jones different from other green finance leaders?

His hands-on involvement, combined with deep experience in both traditional and ethical finance, makes him uniquely effective.

Conclusion

The rise of Mygreenbucks Kenneth Jones signals a vital evolution in how we view money and the environment. With a clear mission, strong leadership, and innovative tools, Mygreenbucks is paving the way for a new generation of investors who believe finance can—and should—do good. As climate and sustainability continue to shape global conversations, Kenneth Jones stands at the forefront, leading by example.

Post Comment